How to Calculate Net Profit Margin

Example of net profit margin calculation Lets say that. Rates subject to change.

Calculating net profit margin is straightforward but learning how to use it well can take time.

. 5 Accredited Valuation Methods and PDF Report. Rates subject to change. Net Profit Margin Net Income Revenue Again lets say your revenue is 50000 and your net income or bottom line equals 8000.

Up to 8 cash back Net profit margin calculation Net profit margin is net profit divided by revenue times 100. Determine the type of profit margin needed. Calculate the companys total revenue.

Place these amounts in the formula. Your gross profit margin would be calculated as follows. How to calculate net.

Your business net profit margin is perhaps the most important figure in all of the. Finally Understand how Valuable your Startup is. To calculate margin divide your product cost by the retail price.

Calculation of net profit margins by using a formula. The formula to calculate net profit margin requires more steps as youll have to also subtract operating and other expenses as well as cost of goods sold. To turn the answer into a percentage multiply it by 100.

You can use a profit margin formula to calculate the profit ratios of your current sales with the following steps. Calculate net profit To determine net. Here we list five steps to calculate net profit margin.

Gross profit is a fixed. Then divide that net profit by the cost. Although it may visible more complicated net profit is calculated for us and shows up on the income statement as net income.

The net profit margin is calculated by dividing net profits by net sales. Whats the difference between gross profit and gross margin. What Is a Good Net Profit Margin.

Net Profit Margin Net Profit Total revenue x 100 Net Profit Margin INR 30INR 500 x 100 Net Profit Margin 600 The. To calculate the net profit margin lets use amounts from the previous example where net income was 15000 and total revenue was 55000. Net Profit Margin NI x 100 Revenue where.

Some analysts may use revenue instead of net. No Financial Knowledge Required. 60 Gross profit margin.

Divide net income by revenue. 450000 750000 060. Ad Reliable data sources.

Here are the steps you can follow to calculate net profit margin. Subtract the total expenses from the total. It tells you what portion of total income is profit.

750000 300000 750000 Gross profit margin. Margin rates as low as 283. Net profit margin total revenue - total expenses total sales You can check your figure against our calculator at the top of our page.

Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. Margin rates as low as 283. Youll need to total up the revenue for the time frame for which youre calculating the net profit margin subtracting any returns and allowances from revenue.

Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee. Calculate the companys total expenses. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee.

Easily Approve Automated Matching Suggestions or Make Changes and Additions.

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

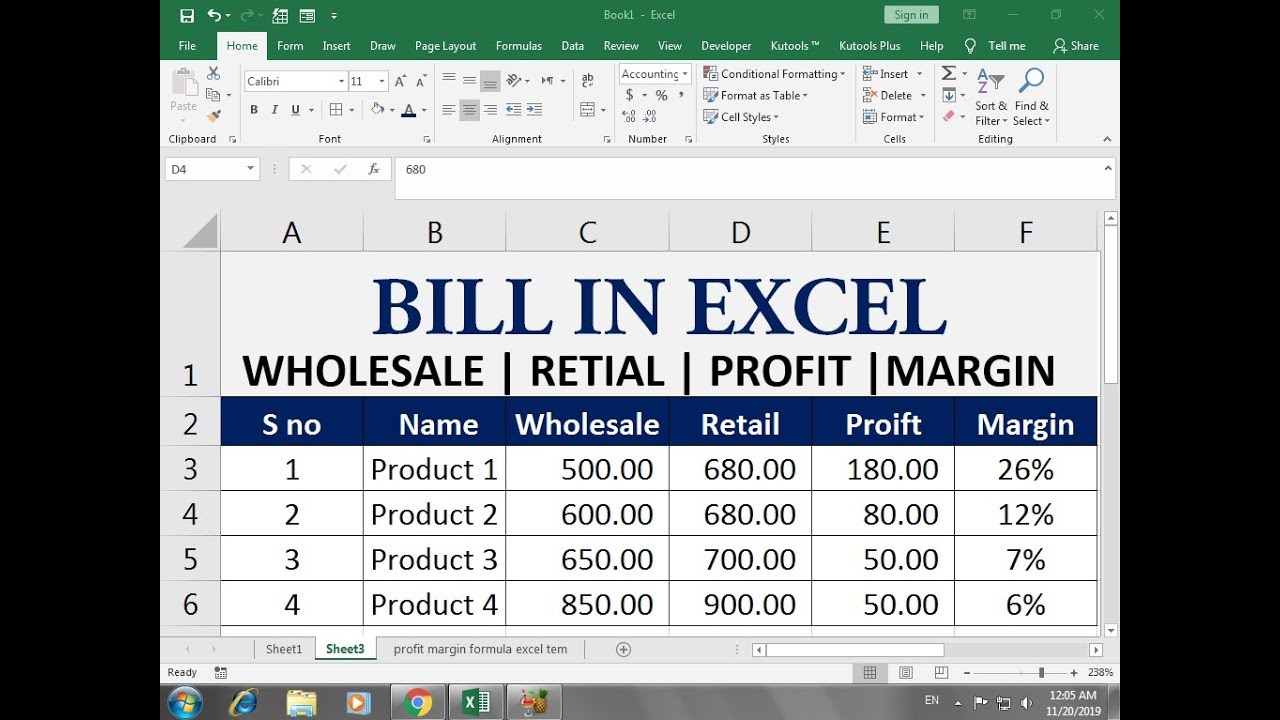

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Expert Advice On How To Calculate Gross Profit Margin Wikihow Online College Online Tutoring Financial Ratio

Profit Margins In The Era Of Unprofitable Tech Platforms Fourweekmba

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

0 Response to "How to Calculate Net Profit Margin"

Post a Comment